International Taxation

Preparation of management accounts for a foreign company

Tax systems of foreign countries

Country

Income tax

VAT

Withholding tax

Personal income tax

Capital gains tax

Currency control

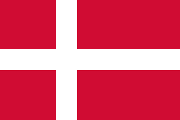

Western Europe

Income tax:

10%

VAT:

4,5%

Withholding tax:

0% (dividend), 0% (interest), 5% (royalty)

Personal income tax:

0-10%

Capital gains tax:

10%

Currency control:

No

Income tax:

23%

VAT:

20%

Withholding tax:

23% (dividend), 0% (interest), 20% (royalty)

Personal income tax:

20-55%

Capital gains tax:

23%

Currency control:

No

Income tax:

25%

VAT:

21%

Withholding tax:

30% (dividend), 30% (interest), 30% (royalty)

Personal income tax:

25-50%

Capital gains tax:

25%

Currency control:

No

Income tax:

12,5%

VAT:

19%

Withholding tax:

0% (dividend), 0% (interest), 10% (royalty)

Personal income tax:

0-35%

Capital gains tax:

12,5%

Currency control:

No

Income tax:

22%

VAT:

25%

Withholding tax:

22% (dividend), 22% (interest), 22% (royalty)

Personal income tax:

Up to 52,07%

Capital gains tax:

22%

Currency control:

No

Income tax:

20%

VAT:

25,5%

Withholding tax:

20% (dividend), 0% (interest), 20% (royalty)

Personal income tax:

12,64-44,25%

Capital gains tax:

20%

Currency control:

No

Income tax:

~ 30%

VAT:

19%

Withholding tax:

25% (dividend), 0% (interest), 15% (royalty)

Personal income tax:

0-45%

Capital gains tax:

15%

Currency control:

No

Income tax:

15%

VAT:

No

Withholding tax:

0% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

14-39%

Capital gains tax:

No

Currency control:

No

Income tax:

22%

VAT:

24%

Withholding tax:

5% (dividend), 15% (interest), 20% (royalty)

Personal income tax:

9-44%

Capital gains tax:

22%

Currency control:

No

Income tax:

0%

VAT:

No

Withholding tax:

0% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

20%

Capital gains tax:

No

Currency control:

No

Income tax:

21%

VAT:

24%

Withholding tax:

21% (dividend), 13% (interest), 20% (royalty)

Personal income tax:

31,48-46,28%

Capital gains tax:

21%

Currency control:

Yes

Income tax:

12,5% / 25%

VAT:

23%

Withholding tax:

25% (dividend), 20% (interest), 20% (royalty)

Personal income tax:

20% / 40%

Capital gains tax:

33%

Currency control:

No

Income tax:

24%

VAT:

22%

Withholding tax:

26% (dividend), 26% (interest), 30% (royalty)

Personal income tax:

23-43%

Capital gains tax:

24%

Currency control:

No

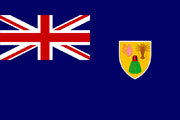

Income tax:

0%

VAT:

5%

Withholding tax:

0% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

20%

Capital gains tax:

No

Currency control:

No

Income tax:

12,5%

VAT:

7,7%

Withholding tax:

0% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

2,5-22,4%

Capital gains tax:

13,25-48%

Currency control:

No

Income tax:

23,87%

VAT:

17%

Withholding tax:

15% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

0-42%

Capital gains tax:

14%

Currency control:

No

Income tax:

13%

VAT:

22%

Withholding tax:

25% (dividend), 25% (interest), 25% (royalty)

Personal income tax:

13,25-48%

Capital gains tax:

13%

Currency control:

No

Income tax:

35%

VAT:

18%

Withholding tax:

0% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

0-35%

Capital gains tax:

35%

Currency control:

No

Income tax:

25%

VAT:

20%

Withholding tax:

0% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

No

Capital gains tax:

25%

Currency control:

No

Income tax:

25,8%

VAT:

21%

Withholding tax:

15% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

8,17-49,50%

Capital gains tax:

25,8%

Currency control:

No

Income tax:

19%

VAT:

23%

Withholding tax:

25% (dividend), 25% (interest), 25% (royalty)

Personal income tax:

13,25-48%

Capital gains tax:

21%

Currency control:

No

Income tax:

No

VAT:

20%

Withholding tax:

No

Personal income tax:

0-45%

Capital gains tax:

No

Currency control:

No

Income tax:

25%

VAT:

21%

Withholding tax:

19% (dividend), 19% (interest), 24% (royalty)

Personal income tax:

19-47%

Capital gains tax:

25%

Currency control:

No

Income tax:

20,6%

VAT:

25%

Withholding tax:

30% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

20%

Capital gains tax:

20,6%

Currency control:

No

Income tax:

8,5

VAT:

8,1%

Withholding tax:

35% (dividend), 35% (interest), 0% (royalty)

Personal income tax:

0-48%

Capital gains tax:

21%

Currency control:

No

Income tax:

25%

VAT:

20%

Withholding tax:

0% (dividend), 20% (interest), 20% (royalty)

Personal income tax:

0-45%

Capital gains tax:

25%

Currency control:

No

Eastern Europe

Income tax:

10%

VAT:

20%

Withholding tax:

5% (dividend), 10% (interest), 10% (royalty)

Personal income tax:

10%

Capital gains tax:

10%

Currency control:

No

Income tax:

21%

VAT:

21%

Withholding tax:

15% (dividend), 15% (interest), 15%(royalty)

Personal income tax:

15 and 23%

Capital gains tax:

21%

Currency control:

No

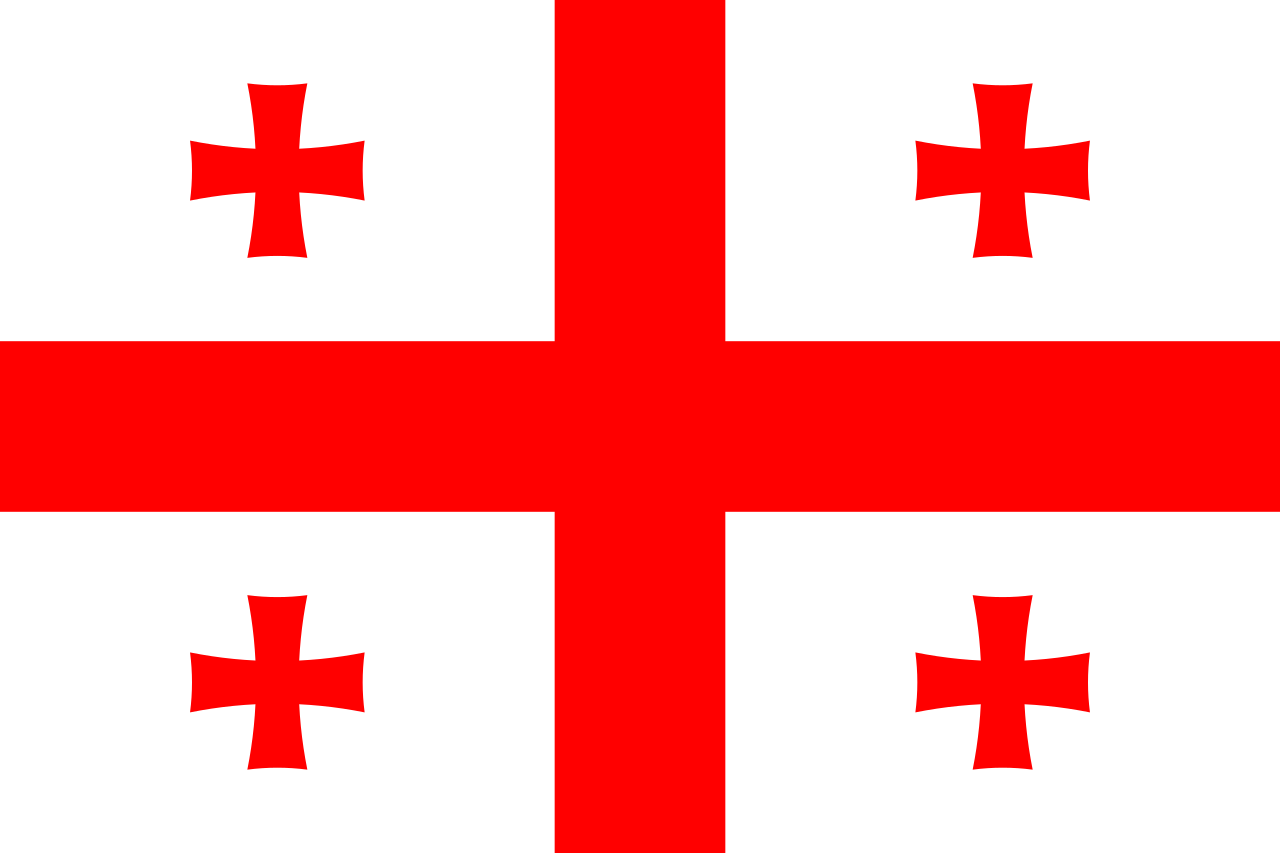

Income tax:

15%

VAT:

18%

Withholding tax:

5% (dividend), 5% (interest), 5% (royalty)

Personal income tax:

20%

Capital gains tax:

15%

Currency control:

Yes

Income tax:

9% + 2%

VAT:

27%

Withholding tax:

0% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

15%

Capital gains tax:

9%

Currency control:

No

Income tax:

9%

VAT:

21%

Withholding tax:

15% (dividend), 15% (interest), 15% (royalty)

Personal income tax:

0%, 9% and 15%

Capital gains tax:

9%

Currency control:

No

Income tax:

16%

VAT:

19%

Withholding tax:

10% (dividend), 16% (interest), 16% (royalty)

Personal income tax:

10%

Capital gains tax:

16%

Currency control:

No

Income tax:

15%

VAT:

20%

Withholding tax:

20% (dividend), 20% (interest), 20% (royalty)

Personal income tax:

10%-25%

Capital gains tax:

15%

Currency control:

Yes

Income tax:

10%, 21%, 24%

VAT:

23%

Withholding tax:

0%/35% (dividend), 19%/35% (interest), 19%/35% (royalty)

Personal income tax:

19 and 25%

Capital gains tax:

21%

Currency control:

No

Offshore jurisdictions

Income tax:

No

VAT:

13%

Withholding tax:

0% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

No

Capital gains tax:

No

Currency control:

No

Income tax:

25%

VAT:

17%

Withholding tax:

25% (dividend), 25% (interest), 25% (royalty)

Personal income tax:

0%

Capital gains tax:

No

Currency control:

No

Income tax:

No

VAT:

10%

Withholding tax:

0% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

No

Capital gains tax:

No

Currency control:

No

Income tax:

25%

VAT:

12,5%

Withholding tax:

15% (dividend), 15% (interest), 25% (royalty)

Personal income tax:

25%

Capital gains tax:

No

Currency control:

No

Income tax:

No

VAT:

No

Withholding tax:

0% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

No

Capital gains tax:

No

Currency control:

No

Income tax:

No

VAT:

No

Withholding tax:

0% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

No

Capital gains tax:

No

Currency control:

No

Income tax:

30%

VAT:

13%

Withholding tax:

15% (dividend), 15% (interest), 25%(royalty)

Personal income tax:

0-25%

Capital gains tax:

15%

Currency control:

No

Income tax:

25%

VAT:

15%

Withholding tax:

15% (dividend), 15% (interest), 15% (royalty)

Personal income tax:

0-35%

Capital gains tax:

No

Currency control:

No

Income tax:

15%

VAT:

No

Withholding tax:

0% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

14-39%

Capital gains tax:

No

Currency control:

No

Income tax:

0%

VAT:

No

Withholding tax:

0% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

20%

Capital gains tax:

No

Currency control:

No

Income tax:

0%

VAT:

5%

Withholding tax:

0% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

20%

Capital gains tax:

No

Currency control:

No

Income tax:

25%

VAT:

7%

Withholding tax:

15% (dividend), 15% (interest), 15% (royalty)

Personal income tax:

0-25%

Capital gains tax:

Regular rate

Currency control:

No

Income tax:

12%

VAT:

No

Withholding tax:

0% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

0-12%

Capital gains tax:

12%

Currency control:

No

Income tax:

13%

VAT:

22%

Withholding tax:

25% (dividend), 25% (interest), 25% (royalty)

Personal income tax:

13,25-48%

Capital gains tax:

13%

Currency control:

No

Income tax:

No

VAT:

2-4%

Withholding tax:

0% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

8-12%

Capital gains tax:

No

Currency control:

No

Income tax:

15%

VAT:

15%

Withholding tax:

0% (dividend), 15% (interest), 15% (royalty)

Personal income tax:

0-20%

Capital gains tax:

15%

Currency control:

No

Income tax:

33%

VAT:

17%

Withholding tax:

15% (dividend), 15% (interest), 15% (royalty)

Personal income tax:

No

Capital gains tax:

20%

Currency control:

No

Income tax:

25%

VAT:

7%

Withholding tax:

10% (5%, 20%) (dividend), 12,5% (interest), 12,5%(royalty)

Personal income tax:

0-25%

Capital gains tax:

10%

Currency control:

No

Income tax:

33,33%

VAT:

12,5%

Withholding tax:

0% (dividend), 15% (interest), 25% (royalty)

Personal income tax:

30%

Capital gains tax:

No

Currency control:

No

Income tax:

25%

VAT:

7%

Withholding tax:

15% (dividend), 15% (interest), 15% (royalty)

Personal income tax:

0-30%

Capital gains tax:

25%

Currency control:

No

Income tax:

No

VAT:

No

Withholding tax:

0% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

No

Capital gains tax:

No

Currency control:

No

Income tax:

No

VAT:

No

Withholding tax:

0% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

No

Capital gains tax:

No

Currency control:

No

Baltic countries

Income tax:

22%

VAT:

24%

Withholding tax:

0% (dividend), 0% (interest), 10% (royalty)

Personal income tax:

20%

Capital gains tax:

No

Currency control:

No

Income tax:

20%

VAT:

21%

Withholding tax:

0% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

25,5%; 33%

Capital gains tax:

20%

Currency control:

No

Income tax:

16%

VAT:

21%

Withholding tax:

16% (dividend), 10% (interest), 10% (royalty)

Personal income tax:

20% / 32%

Capital gains tax:

16%

Currency control:

No

Middle East

Income tax:

No

VAT:

10%

Withholding tax:

0% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

No

Capital gains tax:

No

Currency control:

No

Income tax:

22,5%

VAT:

14%

Withholding tax:

10% (dividend), 20% (interest), 20% (royalty)

Personal income tax:

0-27,5%

Capital gains tax:

22,5%

Currency control:

No

Income tax:

9%

VAT:

5%

Withholding tax:

0% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

No

Capital gains tax:

No

Currency control:

No

Income tax:

23%

VAT:

18%

Withholding tax:

25/30% (dividend), 23% (interest), 23% (royalty)

Personal income tax:

10-50%

Capital gains tax:

15-30%

Currency control:

None

Income tax:

15%

VAT:

5%

Withholding tax:

0% (dividend), 0% (interest), 10% (royalty)

Personal income tax:

No

Capital gains tax:

15%

Currency control:

No

Income tax:

10%

VAT:

No

Withholding tax:

0% (dividend), 5% (interest), 5% (royalty)

Personal income tax:

No

Capital gains tax:

10%

Currency control:

No

Income tax:

20%

VAT:

15%

Withholding tax:

5% (dividend), 5% (interest), 15% (royalty)

Personal income tax:

No

Capital gains tax:

20%

Currency control:

No

Income tax:

25%

VAT:

20%

Withholding tax:

10% (dividend), 10% (interest), 20% (royalty)

Personal income tax:

15-40%

Capital gains tax:

25%

Currency control:

No

South and South-Eastern Asia

Income tax:

25%

VAT:

13%

Withholding tax:

10% (dividend), 10% (interest), 10% (royalty)

Personal income tax:

3-45%

Capital gains tax:

25%

Currency control:

Yes

Income tax:

16,5%

VAT:

No

Withholding tax:

0% (dividend) / 0% (interest) / 2,475% - 4,95% (royalty)

Personal income tax:

2-17%

Capital gains tax:

No

Currency control:

No

Income tax:

25%

VAT:

18%

Withholding tax:

20% (dividend), 20% (interest), 10% (royalty)

Personal income tax:

5-30%

Capital gains tax:

25%

Currency control:

Yes

Income tax:

22%

VAT:

12%

Withholding tax:

20% (dividend), 20% (interest), 20% (royalty)

Personal income tax:

5-35%

Capital gains tax:

5 - 35% / 22%

Currency control:

Yes

Income tax:

12%

VAT:

No

Withholding tax:

0% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

0-12%

Capital gains tax:

12%

Currency control:

No

Income tax:

17%

VAT:

9%

Withholding tax:

0% (dividend), 10% (interest), 15% (royalty)

Personal income tax:

2-24%

Capital gains tax:

No

Currency control:

No

Income tax:

20%

VAT:

5%

Withholding tax:

21% (dividend), 15% (interest), 15% (royalty)

Personal income tax:

5-40%

Capital gains tax:

20%

Currency control:

Yes

Income tax:

20%

VAT:

7%

Withholding tax:

10% (dividend), 15% (interest), 15% (royalty)

Personal income tax:

0-35%

Capital gains tax:

20%

Currency control:

Yes

USA & Canada

Income tax:

38%

VAT:

5%

Withholding tax:

25% (dividend), 25% (interest), 25% (royalty)

Personal income tax:

15-33%

Capital gains tax:

50% of the regular rate

Currency control:

No

Income tax:

21%

VAT:

2,9-7,25%

Withholding tax:

30% (dividend), 30% (interest), 30% (royalty)

Personal income tax:

10-37%

Capital gains tax:

21%

Currency control:

No

South and Latin America

Income tax:

No

VAT:

13%

Withholding tax:

0% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

No

Capital gains tax:

No

Currency control:

No

Income tax:

25%

VAT:

17%

Withholding tax:

25% (dividend), 25% (interest), 25% (royalty)

Personal income tax:

0%

Capital gains tax:

No

Currency control:

No

Income tax:

No

VAT:

10%

Withholding tax:

0% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

No

Capital gains tax:

No

Currency control:

No

Income tax:

25%

VAT:

12,5%

Withholding tax:

15% (dividend), 15% (interest), 25% (royalty)

Personal income tax:

25%

Capital gains tax:

No

Currency control:

No

Income tax:

No

VAT:

No

Withholding tax:

0% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

No

Capital gains tax:

No

Currency control:

No

Income tax:

No

VAT:

No

Withholding tax:

0% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

No

Capital gains tax:

No

Currency control:

No

Income tax:

30%

VAT:

13%

Withholding tax:

15% (dividend), 15% (interest), 25%(royalty)

Personal income tax:

0-25%

Capital gains tax:

15%

Currency control:

No

Income tax:

25%

VAT:

15%

Withholding tax:

15% (dividend), 15% (interest), 15% (royalty)

Personal income tax:

0-35%

Capital gains tax:

No

Currency control:

No

Income tax:

33%

VAT:

17%

Withholding tax:

15% (dividend), 15% (interest), 15% (royalty)

Personal income tax:

No

Capital gains tax:

20%

Currency control:

No

Income tax:

25%

VAT:

7%

Withholding tax:

10% (5%, 20%) (dividend), 12,5% (interest), 12,5%(royalty)

Personal income tax:

0-25%

Capital gains tax:

10%

Currency control:

No

Income tax:

33,33%

VAT:

12,5%

Withholding tax:

0% (dividend), 15% (interest), 25% (royalty)

Personal income tax:

30%

Capital gains tax:

No

Currency control:

No

Income tax:

No

VAT:

No

Withholding tax:

0% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

No

Capital gains tax:

No

Currency control:

No

Australia and Oceania

Income tax:

30%

VAT:

10%

Withholding tax:

30%(dividend), 10% (interest), 30% (royalty)

Personal income tax:

0-45%

Capital gains tax:

30%

Currency control:

No

Income tax:

No

VAT:

2-4%

Withholding tax:

0% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

8-12%

Capital gains tax:

No

Currency control:

No

Income tax:

28%

VAT:

15%

Withholding tax:

0/15/30% (dividend), 15% (interest), 15% (royalty)

Personal income tax:

10,5-39%

Capital gains tax:

28%

Currency control:

No

Income tax:

30%

VAT:

No

Withholding tax:

30% (dividend), 10% (interest), 30% (royalty)

Personal income tax:

0-45%

Capital gains tax:

30%

Currency control:

No

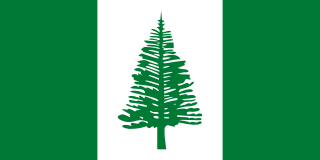

Income tax:

No

VAT:

No

Withholding tax:

0% (dividend), 0% (interest), 0% (royalty)

Personal income tax:

No

Capital gains tax:

No

Currency control:

No

CIS Countries

Income tax:

18%

VAT:

20%

Withholding tax:

5% (dividend), 10% (interest), 10% (royalty)

Personal income tax:

20%

Capital gains tax:

18%

Currency control:

Yes

Income tax:

20%

VAT:

20%

Withholding tax:

15% (dividend), 10% (interest), 15% (royalty)

Personal income tax:

13%

Capital gains tax:

20%

Currency control:

Yes

Income tax:

20%

VAT:

12%

Withholding tax:

15% (dividend), 15% (interest), 15% (royalty)

Personal income tax:

10%

Capital gains tax:

20%

Currency control:

Yes

Income tax:

10%

VAT:

12%

Withholding tax:

10% (dividend), 10% (interest), 10% (royalty)

Personal income tax:

A single flat rate of 10% is applicable to most types of individual income

Capital gains tax:

10%

Currency control:

Yes

Income tax:

8%

VAT:

15%

Withholding tax:

15% (dividend), 15% (interest), 15% (royalty)

Personal income tax:

10%

Capital gains tax:

8%

Currency control:

Yes

Income tax:

15%

VAT:

12%

Withholding tax:

10% (dividend), 10% (interest), 20% (royalty)

Personal income tax:

12%

Capital gains tax:

15%

Currency control:

Yes

Other

Income tax:

25%

VAT:

7%

Withholding tax:

15% (dividend), 15% (interest), 15% (royalty)

Personal income tax:

0-25%

Capital gains tax:

Regular rate

Currency control:

No

Income tax:

15%

VAT:

15%

Withholding tax:

0% (dividend), 15% (interest), 15% (royalty)

Personal income tax:

0-20%

Capital gains tax:

15%

Currency control:

No

Income tax:

25%

VAT:

7%

Withholding tax:

15% (dividend), 15% (interest), 15% (royalty)

Personal income tax:

0-30%

Capital gains tax:

25%

Currency control:

No

Training course

Hong Kong tax system

Training course

Hong Kong tax system

Training course

UK tax system

Training course

UK tax system

Training course

Cyprus tax system

Training course

Cyprus tax system