2nd International Conference G.S.L Law & Consulting Austria 2005

G.S.L law&Consulting Conference: "International Tax Planning: Comprehensive Planning Elements & Practice of Tax Authorities."

About the Conference

Welcome to the home page of the 2nd GSL International Conference 2005.

We would like to take this opportunity to invite you to join us in St. Wolfgang, Austria in June 2005 for a challenging and enjoyable conference – International Tax Planning: Comprehensive Planning Elements & Practice of Tax Authorities. Our event is uniquely planned to ensure:

- most updated tax and bank information first-hand

- extensive networking and personal contacts with prospect customers

- opportunity to present your company and services to the highly targeted audience

This is a must-attend not only for the industry professionals but generally for those who wish to keep up with the latest developments and changes in this ever-expanding field of tax planning, learn new strategies, meet the sharpest legal minds and discuss the most pertinent issues.

About the Conference in brief

The first GSL International Conference took place in Bad Ragaz, Switzerland in October 2003. The conference assembled businesspersons working in different spheres, top managers of huge corporations, high net worth individuals, representatives of European banks, law and accounting firms.

GSL Conference 2005 is meant to bring together practicing lawyers, auditors and bank representatives with their prospect customers – professionals and businesspersons.

GSL International Conference 2005 will be held at the second to none Scalaria Event Resort facing the picturesque shores of the lake Wolfgangsee, Austria. The topic of the Conference is “International Tax Planning: Comprehensive Planning Elements & Practice of Tax Authorities”.

Key Areas to be covered include:

- Double Tax Treaties and Treaty Shopping

- Tax Planning involving Austrian Companies

- Transfer Pricing Regulations

- Low Tax Jurisdictions in Europe

- Limits of Bank and Professional Confidentiality

Keynote Speakers of the Conference:

- Dr. Helmut Loukota, Austrian Federal Ministry of Finance, OECD Fiscal Affairs Committee

- Stephen Gray, Lawyer, member of the ITPA Executive Committee

- Marnin Michaels, Baker & McKenzie, Switzerland

- Dr. Heinz Jirousek, Austrian Federal Ministry of Finance

- Representative of the Belize Financial Services Commission

- Panicos Kaouris, Partner, Price WaterHouseCoopers, Cyprus

Targeted Audience

The 2nd GSL Conference is meant for wide participation of owners and top managers of large and mid-size businesses interested in the most advantageous ways of tax planning, industry professionals (lawyers, tax experts, auditors, etc.) trying to keep up with latest trends in business and taxation. Information will be provided in the format convenient for both professionals and laymen herewith taking into account Russian features and practice.

Perhaps the key characteristics of the GSL Conference participants are high level of professionalism and notable achievements in business or ambition to achieve more. If this is about you – join the GSL Conference!

Why attend

GSL Conference opens up quite a number of options for you:

- update and get focused professional information in a clear format

- establish direct contacts with prospect customers from Russia, the CIS and other countries

- exchange helpful information with other participants

- learn practice of leading tax experts and professionals

- get practical feedback from prospective business partners

- participate in the unrivaled social events program

Be sure to join our distinguished speakers for an informative and specialized event that you can’t afford to miss!

Venue

It was not by chance that we chose Scalaria Event Resort as the venue for holding our 2nd conference - exquisite beauty of the mountains and the lake, modern splendour of Scalaria Hotel are sure to pinpoint the distinguished character of the GSL Conference.

Founded in the 15 century St. Wolfgang is sited near Salzburg. This charming and historic village in a beautiful setting on the shore of Wolfgangsee is surrounded by romance and the Alps making it perfect both for summer and winter holidays. Pure mountain air drifts you away from hustle and bustle of smoggy cities. Don’t you think it’s the high time for you to put aside your lap-top and step out into its hillside or the labyrinth of clean streets, make ride on a horseback or in a boat across the lake?

Steep streets of the ancient St. Wolfgang flourish with little shops where you can find possibly the richest selection of national clothes. Soap flowers, animals and fruits made the same way they were produced by the Benedictine monks are the favourite choice of all tourists. It is an ideal place for those who seek rest and the same time wish to learn something new. Here in St. Wolfgang you can visit baroque cathedrals and the house where Mozart’s mother was born, or view the Alps from 1521m height. Everything is arranged so that you could peacefully enjoy your rest: swimming in the lake, walking on the alpine meadows or boating. This uniqueness will remove you from the distractions of everyday life and surround you with the quiet pleasures you deserve.

The province of Salzburg was well known to the upper classes for its healing salts and calm privacy from the 19th century. Many noble European families had built their houses there. It is the Bohemian and aristocratic past of this dream-like location that attracts tourists from all over the world.

Scalaria Event Hotel and Resort is one-of-a-kind not only in Salzburg, but in Austria too. It specialises in high-class and unique corporate events, shows and presentations. Among the clients who enjoyed Scalaria’s warm welcome were Aston Martin, Lamborghini, Porsche, Shell, Allianz, Siemens, Microsoft and many others.

Scalaria will surprise even the most sophisticated participants of the GSL Conference: a cocktail party under the vaults of the foggy grotto, dinner on the lakeshore, show and wow effects and what not!

Excellent conference facilities and designer rooms go beyond the most demanding expectations. European Lifestyle magazine holds Scalaria Events Resort unrivaled in the world. The hotel prides itself on having quite a number of awards among which there are Meeting Business Award 2002 and World Awards 2002.

Topics&Speakers

GSL offers a new framework of the conference: lectures combined with discussion sessions –information presented as a mix between theory and industry experience facilitating easier understanding of the subject and creating opportunities for legal debate. Topics for the presentations were chosen to cover the most pressing and dominant problems of the international legal practice.

We pride ourselves on our list of speakers, among which there are representatives of the Austrian Ministry of Finance, Austrian Economic Criminal Police, Financial Services Commission, prominent European lawyers, bankers and tax experts ready to share their knowledge and expertise with the conference participants and offer the most comprehensive reviews of the conference topics.

Conference and Panel Discussions Topics:

- Double Tax Treaties and Treaty Shopping Tax Avoidance and Tax Evasion. Role of tax treaties in the global economy. Protection against excessive source taxation. Speaker: Dr. Helmut Loukota, Министерство финансов Австрии

- International Cooperation of Tax Authorities. General principles of exchange of information in tax matters with particular reference to the relations between Austria and Russia. Legal framework of administrative mutual assistance in tax matters with other tax authorities. Practice of processing inquiries regarding specific commercial transactions and the parties involved, Austrian position on those subjects with particular reference to the Austrian legislation on bank secrecy scope and forms of assistance, volume of information to be disclosed refusal grounds. Speaker: Dr. Heinz Jirousek, Министерство финансов Австрии

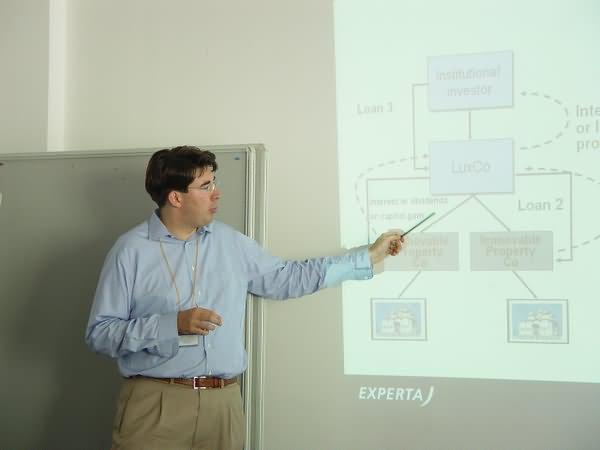

- Legal Aspects of Tax planning involving Austrian Companies. Prudent Management and Use of Austrian Companies in Corporate Construction. Types of Austrian legal entities formation and administration capitalization rules. Holding, trade, royalty and financing structures. Use of foundations. Agency agreement structures. Tax system: income tax, corporate tax, withholding tax, VAT, pecial tax issues and tax privileges. Network of Austrian double tax treaties. Speaker: Wolfgang Zronek, юрист и налоговый консультант.

- Tax Consequences of Transfer Pricing. Transfer Pricing Concept. Legal framework and importance of the OECD. Transfer Pricing Guidelines. Methods used for determining arm's length prices and testing transfer prices. Transfer pricing documentation and penalties: what can multinationals do to ensure worldwide compliance. Importance of defining the location of risks and intangibles. Some planning examples. Speaker Mark Atkinson, Deloitte & Touche, United Kingdom

- VAT Regulations for Cross-Border Transactions. Cross-border VAT refund. Ofshore companies as participants of export/import operations in Europe. VAT reference number manner for tax control over the charge and refund of the VAT from the budget, privileges and allowances, low and zero VAT rates. Speaker: John Messore, AT&T Europe, United Kingdom

- Bearer Shares in the Context of Due Diligence ' Standards. Bearer shares concept: exploration of the nature of the instrument. Regulating requirements of the OECD and FATF. Attempts to deal with the problem: abolition & immobilization of bearer shares. Analysis of the situation in other Caribbean countries. Minimum requirements (documents and information to be provided) for the issue of bearer shares. Speaker: Glenn D. Godfrey, International Financial Services Commission, Belize

- Trusts and Due Diligence: Limits of Possible Confidentiality and Beneficiary/Trustee Relationship. Trusts: concept, types, historical background. Distinctive features of each type of trust relations. Methods of the beneficiary control over the trustee. Procedure of compulsory disclosure of the beneficiary. Legal basis for invalidation of the trust. Disputes resolution: legal succession, division of property, etc. Purpose trust as a new form for confidential ownership. Speaker: Bruce Littman, EFG Bank, Switzerland

- Professional Standards and Responsibility of Independent Services Providers: Lawyers, Auditors, Tax Advisors. EC and FATF Directives regulating the activities of the professional services providers. Difference between the doctrine of attorney secrecy and attorney-client privilege. Access of third parties to the clients' files. When must a tax advisor tip off. Procedure for answering inquiries from abroad. Role of an advisor once an investigation has commenced. Speaker: Martin J. Michaels, Baker & McKenzie, Switzerland

- Cyprus Investment Funds: aspects of Establishment, Management and Taxation. Investment funds in Cyprus: aspects of formation, licensing and administration. Requirements set forth by the state authorities for applicants from Russia and the CIS taxation. Benefits of using Cyprus funds by professional participants of the Russian stock market. Expected changes in the legislation in the foreseeable future. Speaker: Panicos Kaouris, PriceWaterHouse Coopers, Cyprus

- Low Tax Jurisdictions in Europe. New Players, New Options. New EC members - new options for tax planning. Comparative analysis of tax advantages: Cyprus, Malta, Estonia. Aspects of taxation of various types of income in the EC member countries - Austria, Denmark, France, Germany, Ireland, Latvia, Luxembourg, the Netherlands, Norway, Spain, Sweden. New possibilities for Russian business environment. Speaker Stephen Josedh Gray, Shutts & Bowen, United Kingdom

- Accounts and Assets Recovery: Legal Practice of Protecting Interests of the Client. Legal basis for freezing accounts and assets by judicial authorities and law-enforcement bodies. Legal methods & techniques applied for protecting the clients. Freezing and forfeiture possibilities in the case of tax offence. Speaker: Helmut W. Seitz

- Luxembourg Companies: Aspects of Formation, Administration and Taxation. Luxemburg companies - types and uses options formation and administration. Brief review of the Luxemburg tax system. Possibilities of tax treaties. Speaker: Габор Качо

- Estonian Companies in International Tax Planning. Estonia as a new EU-member. Changes in the legislation. Taxation of foreign investments corporation tax. Withholding tax. Formation and administration. Speaker: Ярославас Лукошевичус

Speakers

Program

The key characteristic that makes GSL Conferences stand out from the crowd is a unique combination of business seminars and social events allowing the participants to get the best of the event. This is a chance to update your knowledge, find the best solutions for your business, establish new contacts through extensive networking and have some rest.

23 June, Thursday (Day of Arrival)

- 18.00-18.30 Welcoming Cocktail in the Scalaria Hotel. Registration of delegates Mini-Presentations made by the conference participants.

- 19.00-23.00 Dinner at lake Wolfgangsee side. Mini-presentations by conference participants.

24 June, Wednesday (Main Day of the Conference)

- 08.00-09.00 Breakfast

- 09.00-09.15 Opening of the Conference. Chairperson's Welcome and Opening Address

- 09.15-10.45 Presentations

- 10.45-11.00 Coffee-break

- 11.00-12.30 Presentations

- 13.00-14.30 Lunch

- 14.30-16.00 Presentations

- 16.00-16.15 Coffee-break

- 16.15-17.45 Presentations

- 19.00-19.30 Boat transfer to the Restaurant

- 19.30-21.30 Dinner at Zur Post - traditional Austrian restaurant

- 21.30-22.00 Return to the Hotel

- 22.30-00.00 Cocktail Party at the Mystic Underworld (Disco and Bartender-show)

25 June, Friday (Second Day of the Conference)

- 08.00-09.00 Breakfast

- 09.00-09.15 Opening of the Conference Day Two. Chairperson's Recap of Day One

- 09.15-10.45 Presentations

- 10.45-11.00 Coffee-break

- 11.30-13.30 Panel discussions I, II, III, IV

- 13.30-15.00 Kunch

- 15.00-18.00 Rack Railway up to the Schafberg summit

- 18.00-19.30 Dinner at Himmelspforte Restaurant

- 21.30-23.00 Soul Kitchen Show in Circus Circus

- 23.00-23.30 Fireworks at the terrace

26 June

- 08.00-10.30 Breakfast

- 12.00-16.00 Guided Tour to the Saltmines & UNESCO World Heritage village Hallstatt

- 16.00-17.00 Lunch at the local brewery

- 1.00-21.00 Transfer to Munich (when applicable)

Excursions

Rack Railway up to the Schafberg Summit, 25 June, Saturday

Your guide will meet you at Scalaria and accompany you on a 5 minutes’ walk to the station. You will then take the old steam locomotive up to the summit, one of the most beautiful mountains of the Salzkammergut region. During the journey the panorama offered is breathtaking. When you finally arrive at the peak of the Schafberg, 45 minutes later at a height of 1780 m, five of the most beautiful lakes will open up to your eyes.

We are pleased to arrange lunch for you at the mountain hut of “Himmelspforte” (“Celestial Gate”).

Celtic Village and Saltmines, 26 June, Sunday

On leaving the hotel the bus will take you to the world famous Celtic village Hallstatt – UNESCO World Heritage. There the funicular brings you up to the “salt mountain”. After a short walk, you will reach the entrance to the saltmines where the Celts started saltmining more than 3000 years ago. Back in the daylight, you will have lunch at a local brewery. After lunch you can have a walk through the picturesque village Hallstatt.

Registration & Prices

For your convenience we offer a number of different participation options depending on accommodation type and services included in the package. Please choose the one most appropriate for your needs and comfort.

- Infoset package. Package Price: 250 EUR. Includes: conference materials (texts of presentations and practical guidelines)

- Visitor package. Includes: participation in the official conference program including lectures and panel discussions, Conference materials (texts of presentations and practical guidelines), meals: lunches and dinners (during excursions as well), social events of the program (shows, cocktails and excursions), Gala-dinner.

- Economy package. Includes: accommodation in a double room of a near-by hotel 4****, delegate registration fee, Conference materials (texts of presentations and practical guidelines), social events of the program (shows, cocktails and excursions), meals: breakfasts, lunches and dinners (during excursions as well), participation in the official conference program including lectures and panel discussions, Gala-dinner. Package Price: 2750 EUR.

- Business package. Includes: accommodation in a standard First-class room of Scalaria event resort, delegate registration fee, Conference materials (texts of presentations and practical guidelines), social events of the program (shows, cocktails and excursions), meals: breakfasts, lunches and dinners (during excursions as well), participation in the official conference program including lectures and panel discussions, Gala-dinner. Package Price: 2950 EUR.

- Luxury package. Includes: single accommodation in a Junior Suite of Scalaria, delegate registration fee, Conference materials (texts of presentations and practical guidelines), social events of the program (shows, cocktails and excursions), meals: breakfasts, lunches and dinners (during excursions as well), participation in the official conference program including lectures and panel discussions, Gala-dinner. Package Price: 3950 EUR.

- VIP package. Includes: single accommodation in a VIP room of Scalaria, delegate registration fee, Conference materials (texts of presentations and practical guidelines), social events of the program (shows, cocktails and excursions), meals: breakfasts, lunches and dinners (during excursions as well), participation in the official conference program including lectures and panel discussions, Gala-dinner. Package Price: 4950 EUR.