Crypto Market: the Review of 2019

According to experts, the outgoing year was not so bad for the cryptocurrency market, especially compared to the crypto winter of 2018.

Публикация

Статья опубликована на портале Bitnews Today

How the market capitalization has changed, how many times Bitcoin and other coins have risen and fallen — read the article by Bitnewstoday.

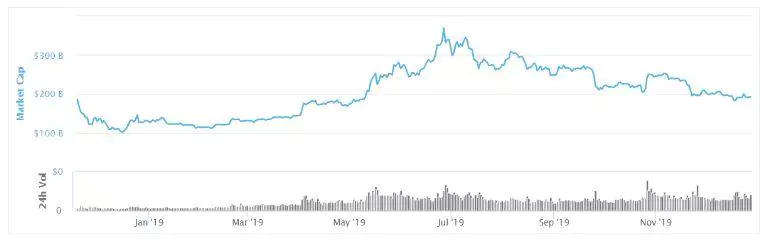

THE TOTAL CAP OF ALL CRYPTOCURRENCIES HAS GROWN

In 2019, the capitalization of the crypto market grew by 54% — from $126 to $194 bln. The beginning of the year was quite calm, no sharp changes in the total value of crypto coins were noted. At the end of March, the market revived and capitalization began to increase rapidly. The most successful time for crypto was in the middle of the year, when the total value of all cryptocurrencies came close to the mark of $370 bln, but after that the trend turned bearish and capitalization decreased.

Pic 1. Dynamics of cryptocurrency capitalization in 2019

Source: coinmarketcap

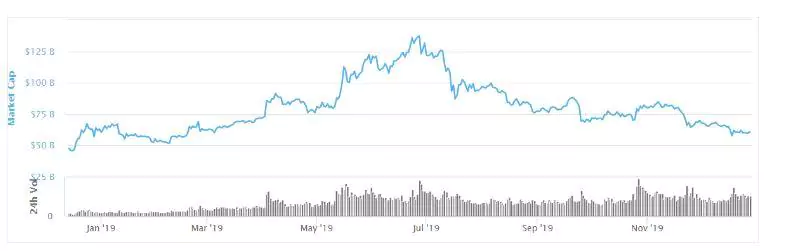

The capitalization of altcoins has not changed during the year. At the beginning of 2019, their total cap was at around $60.4 bln, and so far it has reached only $60.8 bln (an increase of less than 1%). The maximum aggregate value of cryptocurrencies with the exception of bitcoin was recorded on June 27 — and it reached $137 bln.

Pic 2. The dynamics of the altcoins’ total value

Source: coinmarketcap

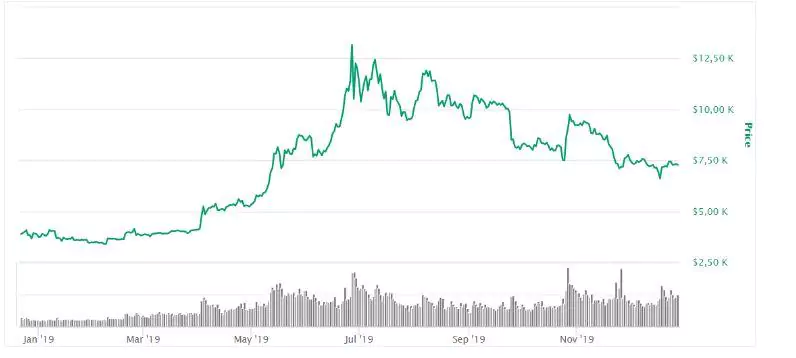

BITCOIN GREW STRONGER

Throughout the year, Bitcoin has been building up its market position. The share of the most significant cryptocurrency has grown from 52% to almost 69%. In September, this figure was close to 71%.

BTC capitalization doubled — from 67 to 132 bln dollars, and the price — from 3.7 to 7.3 thousand dollars. At the end of June, the price of bitcoin rose above the mark of 13 thousand dollars.

Pic 3. The dynamics of Bitcoin price

Source: coinmarketcap

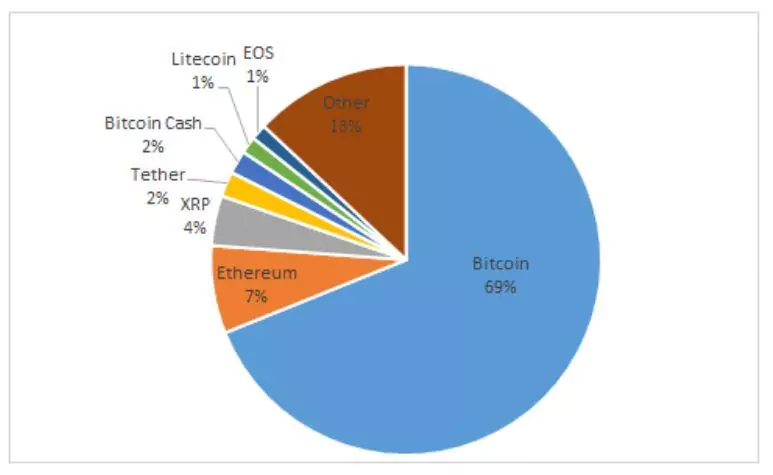

WHO KEPT THE LEADERSHIP?

The TOP 7 cryptocurrencies in terms of capitalization start with Bitcoin and also include Ethereum, XRP, Tether, Bitcoin Cash, Litecoin, EOS.

Pic 4. The structure of the cryptocurrency market

Source: BNT, according to Coinmarketcap data

The share of Ethereum decreased by 4 percentage points by the end of the year, and the price decreased from 136 to 128 dollars. The share of XRP decreased almost three times — from 11.5% to 4.3%. Tether, on the contrary, increased its share — from 1 to 2.2%.

THE MOST SIGNIFICANT EVENTS

Alexander ALEKSEEV, managing partner of GSL Law & Consulting, considers the rise of bitcoin price in late October to be the most significant event of the cryptocurrency market of the outgoing 2019:

“Bitcoin rose from a position of 7.3 thousand dollars to 10 thousand dollars. Well, it scratched the mark of 10 thousand dollars, jumped by 35%. As far as I know, this price spike was not predicted by anyone.”

According to most cryptocurrency analysts, the trigger for this rise was the adoption of cryptocurrency activities by the Chinese authorities. This year, the Communist Party did not include cryptocurrency manipulations in the list of “undesirable” activities. Along with this, the leader of the Communist Party, Xi Jinping, said that the blockchain in China has prospects for development.

Experts also attribute the following to the most significant events:

- Launch of the Bakkt platform. Although it did not live up to expectations for an immediate market growth, but it eventually happened and it presented the interest of institutional investors to the cryptocurrency market.

- Prohibitions and restrictions of Libra and TON projects by various regulators.

- The correlation of the cryptocurrency market with traditional financial markets amid a trade war between the US and China.

Launch of the Bakkt platform. Although it did not live up to expectations for an immediate market growth, but it eventually happened and it presented the interest of institutional investors to the cryptocurrency market.

Prohibitions and restrictions of Libra and TON projects by various regulators.

The correlation of the cryptocurrency market with traditional financial markets amid a trade war between the US and China.

“The trade war between the USA and China allowed Bitcoin to easily overcome the psychological mark of 10 thousand dollars, and the news about the launch of the Libra project led the price to absolute highs above 13 800. The market fell throughout the second half of the year. At first Bakkt did not live up to expectations, then regulators banned Libra, then the US and China suspended the trade war, then they did not let TON launch. Against this background, buyer activity and interest in the crypto declined, and the market moved from highs to bottoms,”

Changing the opinion of the Chinese authorities about cryptocurrencies next year will have a positive impact on the market. Most experts expect the rapid growth of bitcoin together with large altcoins and an increase in market capitalization to $500 bln in 2020.

Image by Snapp Comms

Добавить комментарий